I first heard about India getting into a global bond index sometime in 2012. I was a part of an informal roundtable committee on the Infrastructure Debt limits for foreign investors. As part of our broader recommendations to the regulator was to consider enabling regulations and structures to get India to be a part of a global bond index.

It shouldn't have taken this long, but that is India for you. The need to get everyone on board for a decision to prevail. There seems to have been a lot of resistance from the index providers as well. Many steps from the ministry and regulators have made this happen. Most important of it was from the Central Bank, The Reserve Bank of India (RBI).

The idea to launch the 'Fully Accessible Route' (FAR) Government bonds which will have no limit on foreign ownership. India has always had an overall cap on foreign investments into bonds. Initially if was a USD $bn limit. Till about 2012, the total limit was below USD 20 billion.

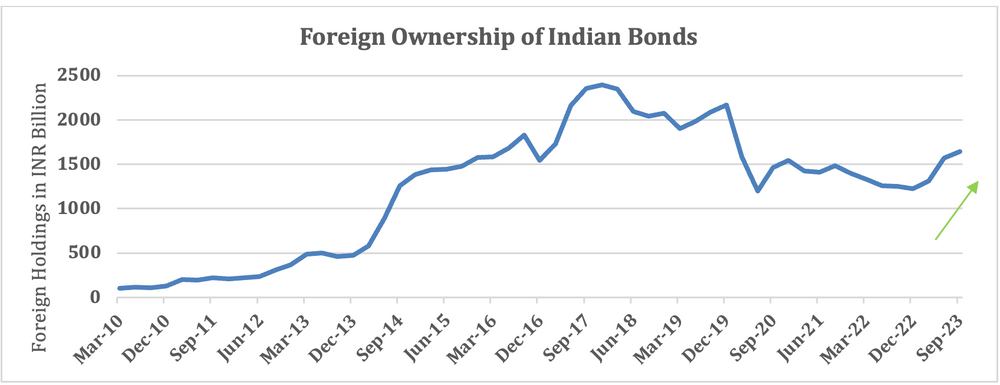

Under Governor Raghuram Rajan, the RBI moved to medium-term framework and opened up limits to as a % of outstanding. Although, in that period, India got lot of foreign flows into the bond markets (see chart II), but the index providers were not impressed and wanted access without limits.

India’s perennial ‘Jugaad’ mentality kicked in and the RBI found a via-media. Do not give up complete control but offer the index providers a means to overcome their resistance.

These 'FAR' securities overcame the restriction of the overall limit on foreign investments in Indian bonds which was linked to as a % of outstanding. Foreign investors can now own 100% of certain bond issuances as notified.

JP Morgan will add these ‘FAR’ bonds into its index.

The outstanding under the ‘FAR’ government bonds is ~USD 420 billion. Current foreign investments into these bonds are ~USD 12 billion. Total foreign investments in all Indian government bonds is ~USD 21 billion.

This outstanding is already large enough for index providers to consider. Also, almost all newly issued government bonds are categorized as ‘FAR’ and hence the investable universe size will increase every year ~USD 100 billion.

Today, technically, if foreign investors fall in love with Indian government bonds, they can invest USD 400 billion in FAR bonds!

The talk on index inclusion has been on for 3 years now and every September it sort of became like a ritual. . Our colleagues from Quantum Asset Management discussed this issue in past – India Bonds Going Global (September 2022) andWill Foreigners ‘Bond’ with India (September 2021).

The index providers, of course, had asked for other changes in ease of access. India has however done very little on that front. In fact, we have regressed. Account opening processes though have become much simpler but a foreign investor still needs to register before investing.

EuroClear – Indian government bonds settling on the Euro-Clear system hasn’t materialized. This was initially seen as a pre-requisite for index inclusion. Global funds will thus have to adhere to T+1 matching and settlement.

Tax Certificate – Every Capital repatriation requires a tax certificate; this will be a hindrance for passive re-balancing and trading

Withholding Tax – India has 5% withholding tax on interest. This has now been raised to 20%. Yes, you will have to pay 20% tax on coupons from Indian government bonds.

However, ouster of Russia from the index last year has left the index more concentrated among few countries. Now, 7 countries in the JP Morgan GBI-EM Index account for ~70% of the total allocation, while the remaining 13 countries have a combined weight of near 30%.

India’s index inclusion would add diversification to the index, enhance the yield and expand the market opportunities for global debt investors.

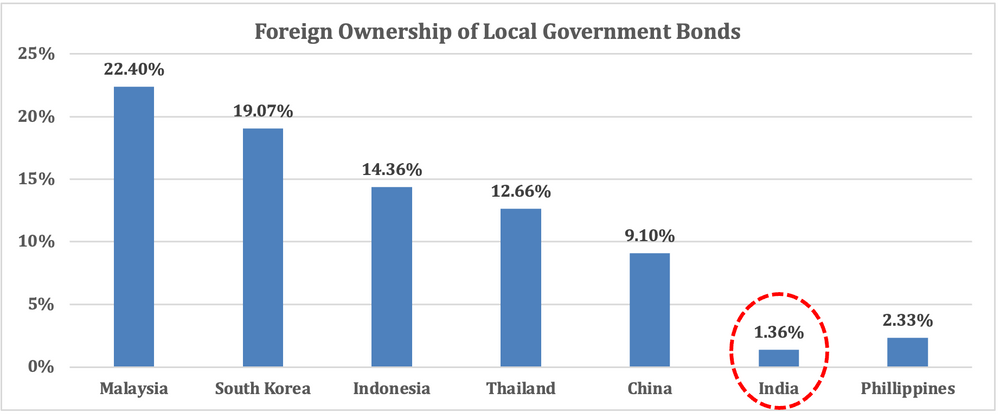

Chart -I: Indian Bonds are under-owned by foreigners

Source – www.asianbondsonline.adb.org, RBI, Quantum Research,

Data for India as of March 2023 and all others are as of March 2022

With JP Morgan paving the way against these odds, we should expect inclusions in to global bond indices from FTSE and more importantly into Bloomberg Aggregate Bond Index.

The JP Morgan inclusion is due from June 2024 with an eventual 10% weight to be reached in early 2025. Estimates put the 'active and passive' flows from funds benchmarked to JP GBI-EM in the USD 25 billion range.

If the FTSE/Bloomberg inclusion happens, there is another USD 15-25 billion expected. To put this in perspective, the current outstanding investment by foreign investors in Indian government bonds is ~USD 20 billion. So, this is a big thing from a flow and investing perspective. We should add to that, proprietary positions by banks/ hedge funds front-running the fund flows, some of which has already started.

More importantly, index inclusion will open a source of consistent demand for Indian bonds from investors who track the index, particularly from the exchange-traded funds or ETFs. Even active investors will be more comfortable investing in India when it becomes part of the index.

Apart from the direct impact of additional demand, there are other benefits as well.

The new demand source for government bonds might also help in deepening the corporate bond market in India.

Potential foreign inflows into Indian debt will expand the source of foreign capital which in turn will strengthen India’s balance of payment situation and deepen the market for the Indian Rupee.

Foreign holding of bonds would enforce much stricter discipline on the fiscal and monetary policy.

Increased participation by foreign investors, would enhance the credibility of the Indian bond market and will make it easier for the government and the corporate sector to raise debt capital from global investors.

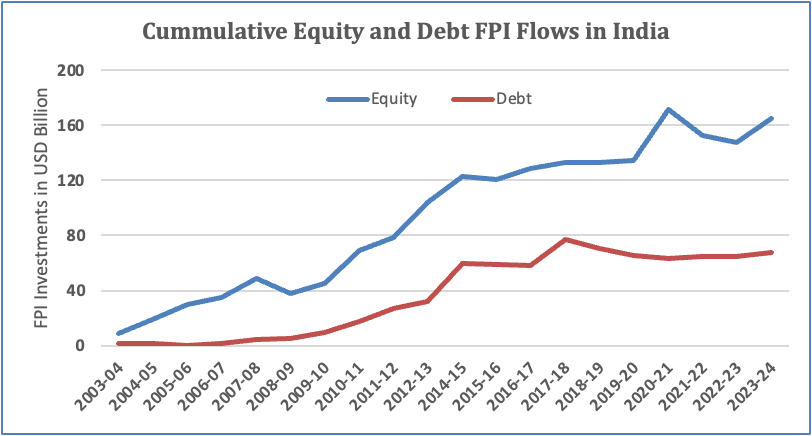

Chart – II: Foreign investors turned buyer in Indian bonds in 2023.

Source – RBI, Quantum Research, Data up to September 2023

Clearly, India has a lot to gain from Index inclusion. However, there are downsides as well. High foreign holding of debt might expose Indian markets to external shocks. Large inflows-outflows linked to developments in the global markets can have an outsized impact on the domestic bond and currency markets. Thus, additional safeguard measures will have to be deployed to deal with any such external shocks.

So far in 2023, foreigner investors (FPI) have been consistent buyer in the bond market with net purchase of Rs. 219 billion (USD 2.7 billion) of government bonds.

Over the next 2-3 years, a decent portion of India's annual net government bond supply (~USD 140 bn) will be funded by these flows. As the chart I shows, India is an outlier. For its size of the economy (fifth largest) and its bond markets (3rd biggest in Asia), foreigners have very little participation. That is about to change now.

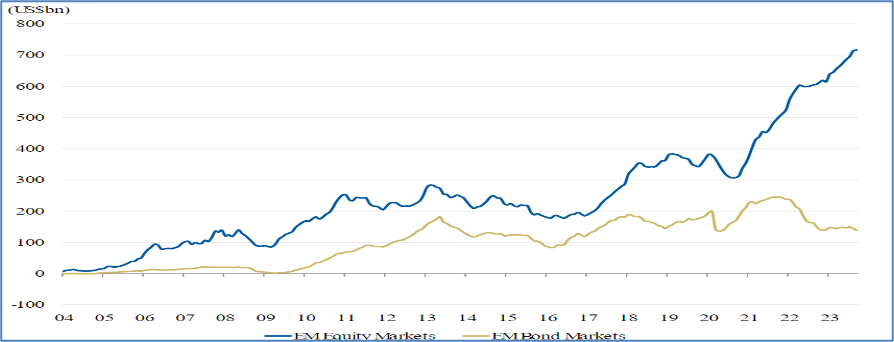

Investing in Local Currency Emerging Market Bonds (LCEMB) has multiple risks: country; currency and rates. The trend of the US dollar also determines a large part of the allocation and potential risk and returns. The US dollar has been on a secular bull-run in the last decade. Hence, we are yet to see large consistent and dedicated allocation to LCEMB as a separate asset class. Given the volatility, we have always recommended that clients have a minimum 2-3 years investment horizon while investing in EM or Indian Fixed Income. Timing and valuations at entry of course matter.

Chart III: EM Bond Flows are closely linked to US Dollar movements

Source: Morgan Stanley Research, EPFR Data till October 4th, 2023

This is also why EM Equities have higher foreign participation than EM Bonds. In fact, over the last 4 years, EM bonds have seen net outflows. We saw that in India as well as seen in Chart II.

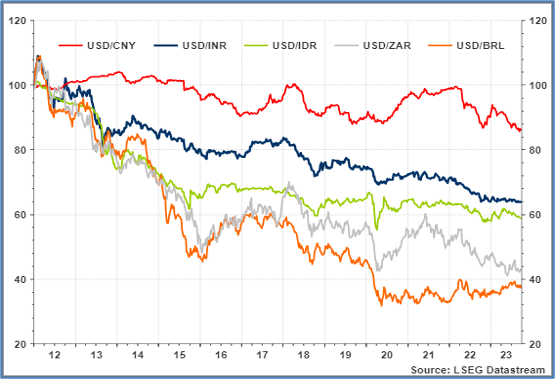

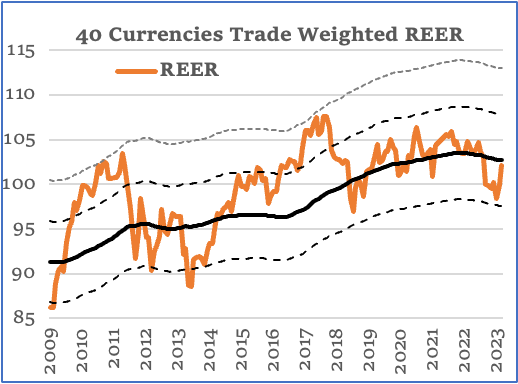

The Indian Rupee since it being classified as ‘fragile five’ in the summer of 2013 in the aftermath of the Ben Bernanke ‘taper tantrum has actually held up pretty well. Inflation targeting, positive real yields and in general stable management of macro has instilled confidence. India has also been large net recipient of FDI flows which the RBI has gladly gobbled up to build up its foreign exchange reserves.

Chart IV: INRnot ‘fragile’ anymore

Source: Refinitiv, rebased from 2013

Chart V: INR is reasonably valued

Source: RBI

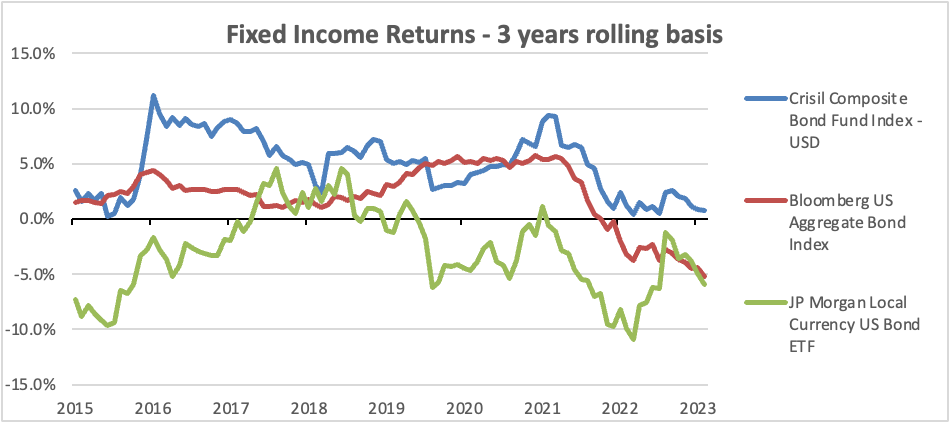

Chart VI: India Fixed Income Returns have thus held up well despite the rise in rates#

Source: Crisil, Datastream, US and EM local currency are respective ETFs., Data till Sep 2023; past performance is not an indicator of future results

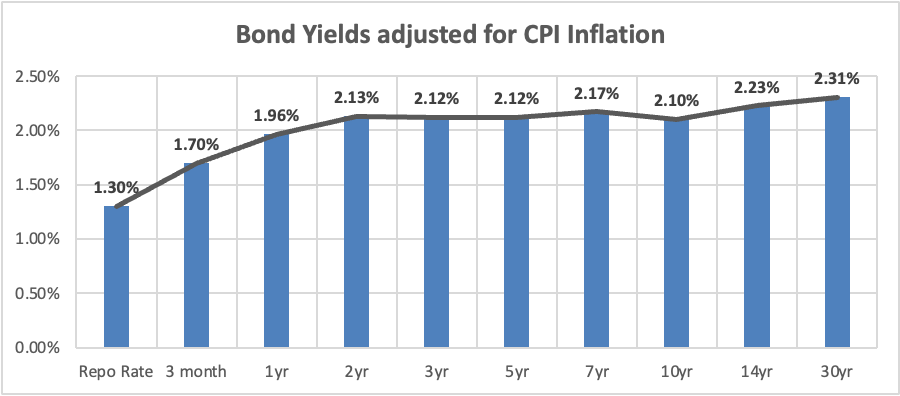

With most of the government bond yield curve above 7.0%, there is decent accrual available at current levels. Even in the real term (adjusted for inflation), government bonds are offering meaningful positive real yield. With expected CPI inflation of 5.2% (RBI’s Q1FY25 inflation estimate) and a 1-year Gsec yield at 7%, the real yield is around 180 basis points.

Chart – VII: Real yields are positive and reasonably high

Source – Refinitiv, Quantum Research, Data as of September 18, 2023

As mentioned, the index inclusion is indeed a big deal for the Indian bond market. Although, we don’t see a large rally either in the bond yields or for that matter in the currency. The RBI will be on the opposite side of the foreign buying.

Net demand/supply due to buying by foreign investors will be netted off by either OMO sales or no OMO purchases by the RBI. The same will be seen in the FX markets where the RBI will intervene and add reserves.

However, from the perspective of the larger impact on the bond market.

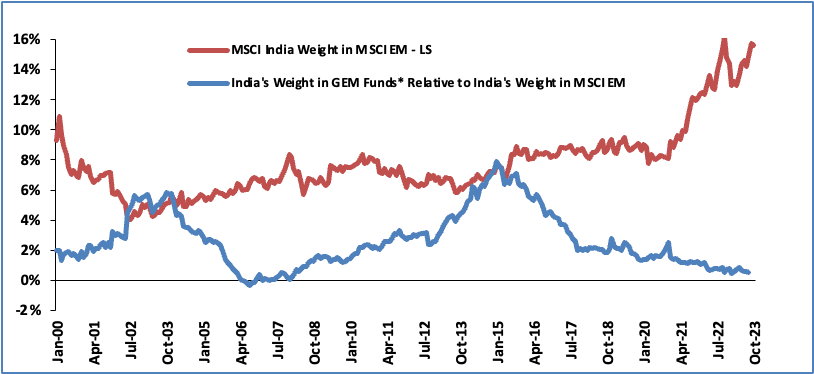

Think of the evolution of foreign participation in Indian equity markets in the last 20 years. India's weight in global equity indices and in global equity portfolios has increased. This is that moment for India bonds which will play out over the next decade.

Chart VIII: India now accounts for ~15% of MSCI EM Equity Index

Chart IX: India bonds will see similar participation.

Source – NSDL, Quantum Research, Data as of October 12, 2023

Explore how our two main strategies – Predictable India Equity and India Integrity Equity - with demonstrated success of our tried and tested research and investment processes can ensure your India equity allocation will have higher predictable outcomes and no surprises.

20+ years of India Long-only, Liquid, High-Governance, Margin of safety = Predictability

Integrity screen since 1996, strategy Track record since 2000.

Liquid, proprietary Integrity Scores, Financial Soundness

Integrity Screen since 1996, enhanced criterion since 2015, strategy Track Record since 2019; strategy AuM: $9.7 mn Mandate Capacity: $5 billion

CIN: U65990MH1990PTC055279

SEBI PMS Reg. No.: INP000000187

1st Floor, Apeejay House,

3 Dinshaw Vachha Road, Backbay Reclamation,

Churchgate, Mumbai 400020, India

Tel: +91-22-6144 7900 / 22830322

Fax : 91-22-2285 4318

Email: info@QASL.com

In case of any grievance/complaint, you may contact Mr. Piyush Thakkar, Chief Executive Officer at Complaint@qasl.com. Investor can initiate dispute resolution by harnessing online conciliation and/or online arbitration through Online Dispute Resolution (ODR) portal SMARTODR. To know more about grievance redressal mechanism click here.

© 2024 Quantum Advisors India | Designed and developed by Solharbor