A recent shift in public equity allocation strategies is driving investors away from China and towards other Emerging Markets, notably India. Prompted by China's underperformance and political concerns, this change raises key questions about appropriate portfolio weightage, risk, and the historical track record of Emerging Market ex-China allocations. While global benchmarks have traditionally guided allocation decisions, an increased focus on India, with its growing role in the global economy, suggests the need for a dedicated investment approach.

Over the last 2 years, we have seen a new allocation trend in public equities. Strung by the under performance of China, impacted by the political concerns over investing in China or the desire to invest in China directly, has made allocators to look for Emerging Markets (EM) ex China allocation.

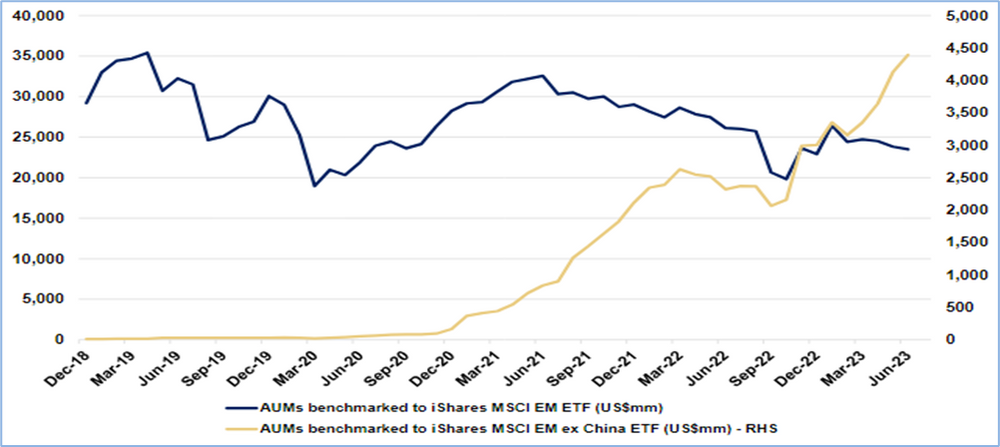

We have seen a few RFPs (Request for Proposals) being floated by asset owners and wealth managers asking for such an allocation. The ETF industry of course has been quick to respond to this demand and has seen new launches and increasing AuM flowing into such products.

Chart 1: Flows increase to EM ex China allocation

(Source: Morgan Stanley Research)

India’s weight will be higher in an EM ex China allocation. Investors will be better off from the India market performance than an EM allocation. However, there are few issues in such an allocation:

What allocation percentage does this deserve? How do you weight this in your portfolio?

No past Performance track record of a EM ex-China Allocation

Country and Stock Allocation and what that means for risk and return

Re-weighting based on re-allocation of China weights as per stocks, sectors, countries?

What does larger weights in countries like Taiwan, South Africa, Saudi Arabia, Qatar as few examples mean to overall return, risk, geo-politics, exposures.

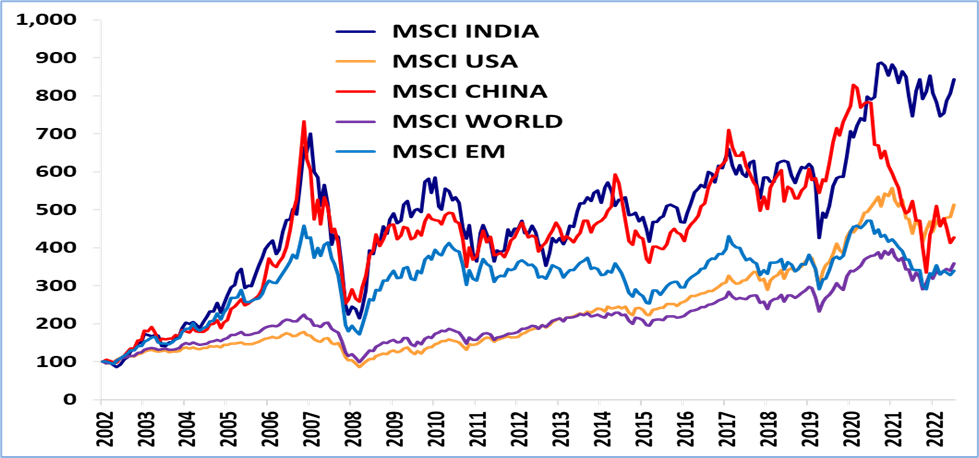

We have argued against Emerging Markets as a basket investment. It does give diversification but the countries classified as EM are so dramatically different. It is no surprise that over the last decade EM as an allocation has been such a laggard.

Chart 2: Emerging Markets as an allocation has been disappointing

Source: MSCI Indices, 20-year data; rebased to 100 from December 2002 till June 2023

India and China seems to have kept up the overall EM performance for some time. However, post 2020 given China’s correction, even that has led to a big drag on EM performance.

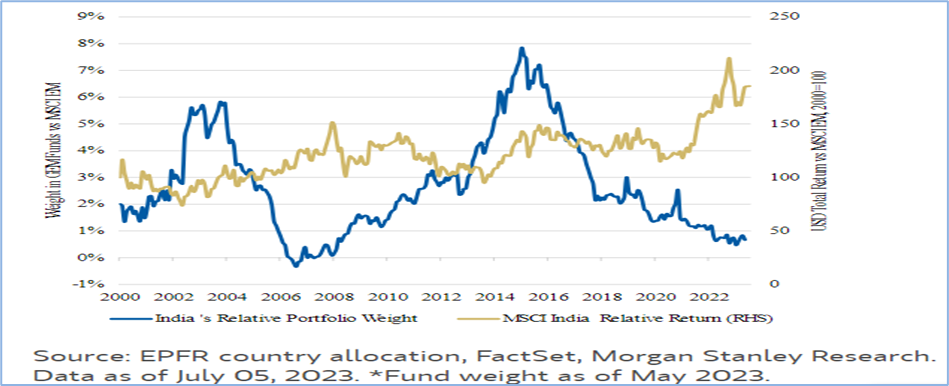

Active managers India weights have also been all over the place and as we know Global Emerging Market (GEM) and Global Funds have been large net sellers in Indian equities in 2021/22 to ensure that the India weight remains close to its benchmark weight.

Chart 3: India’s relative outperformance forces EM managers to sell India

(Source: Morgan Stanley Research)

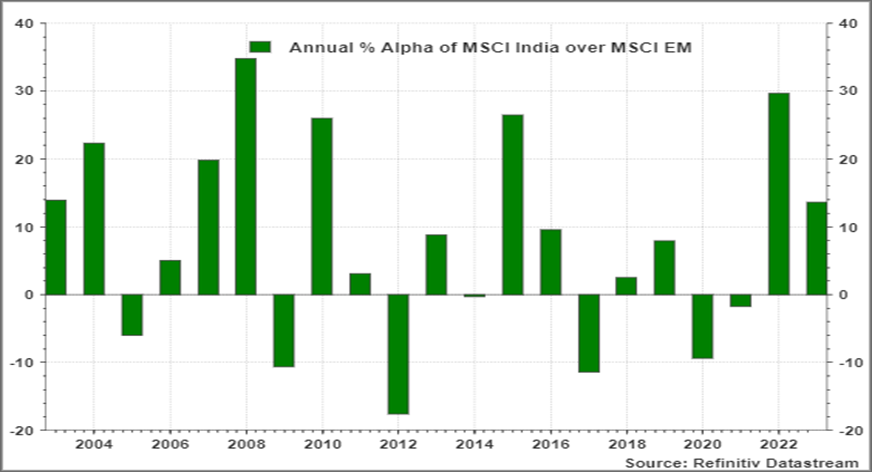

We understand allocators problems on thinking of a dedicated India allocation. However, how long can they ignore India’s secular long-term outperformance to EM and China.

Chart 4 and 5: Under allocation to India hurts your overall performance.

As we have shown over many of our commentaries, that global investors needs to think of a dedicated allocation to India. By choosing to benchmark their allocation to an ‘artificially’ constructed Emerging Markets Index or a sleeve of that with EM ex-China, is lazy and is acting against their own interests. It is very difficult to comprehend and or predict, what a basket of countries and stock weightings as decided by an index provider means to your risk and return.

We recognize the difficulty of an asset allocator to move away from the ‘tyranny of the benchmark’ as referred to by a CIO of a public pension plan. The investing world is bound by reference benchmarks, reference portfolios and hence reference allocations.

Asset allocators who invest for decades in the future though need to make that decision to have higher allocations in high conviction investment avenues.

In todays, economic and geo-political world, India is by far the only country where an investor can make a long-term, strategic, secular allocation across all asset classes.

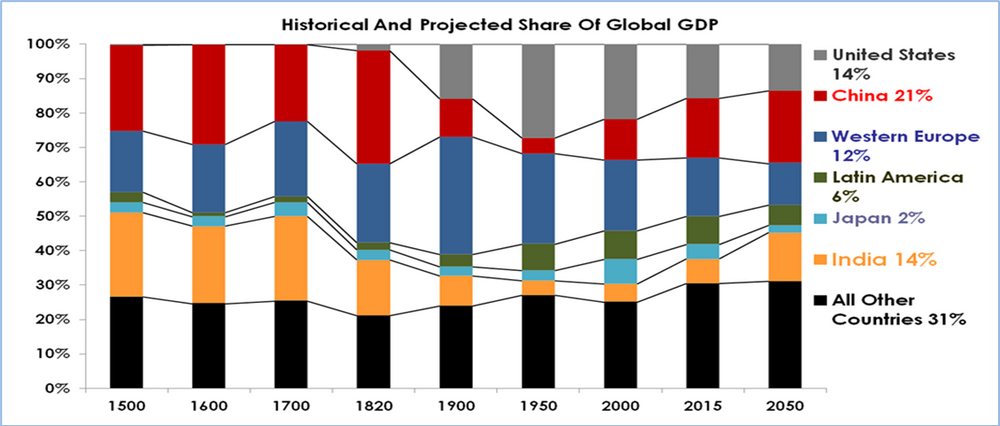

One way to look at an India allocation is think about India’s share of global GDP (~3%) and its likely trajectory 10-20 years out to ~5%). And then look at your effective allocation to India as part of a EM or EM ex-china allocation. Then use a dedicated India allocation over and above your effective weight to reflect India’s growing share in the global economy.

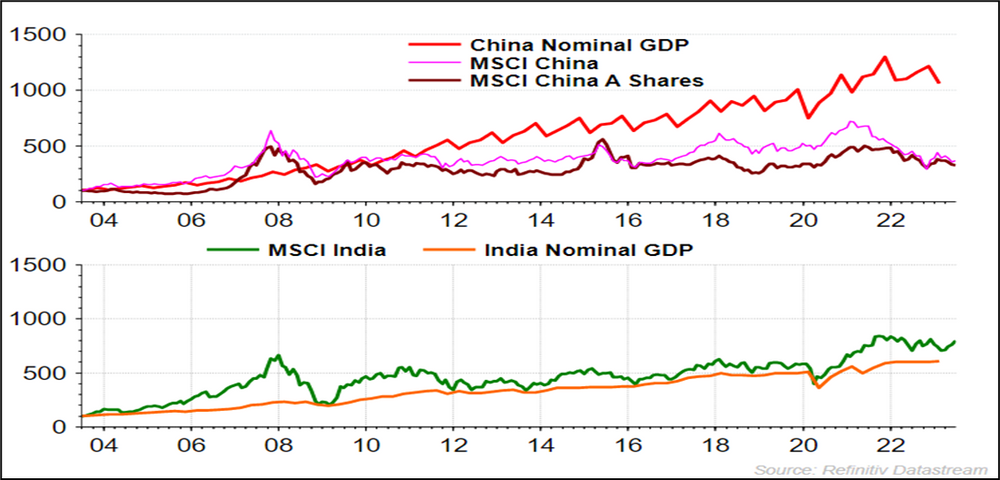

Chart 6: India’s economic growth is reflected in Market Returns

Chart 7: India cannot be ignored anymore

Explore how our two main strategies – Predictable India Equity and India Integrity Equity - with demonstrated success of our tried and tested research and investment processes can ensure your India equity allocation will have higher predictable outcomes and no surprises.

20+ years of India Long-only, Liquid, High-Governance, Margin of safety = Predictability

Integrity screen since 1996, strategy Track record since 2000.

Liquid, proprietary Integrity Scores, Financial Soundness

Integrity Screen since 1996, enhanced criterion since 2015, strategy Track Record since 2019; strategy AuM: $9.7 mn Mandate Capacity: $5 billion

CIN: U65990MH1990PTC055279

SEBI PMS Reg. No.: INP000000187

1st Floor, Apeejay House,

3 Dinshaw Vachha Road, Backbay Reclamation,

Churchgate, Mumbai 400020, India

Tel: +91-22-6144 7900 / 22830322

Fax : 91-22-2285 4318

Email: info@QASL.com

In case of any grievance/complaint, you may contact Mr. Piyush Thakkar, Chief Executive Officer at Complaint@qasl.com. Investor can initiate dispute resolution by harnessing online conciliation and/or online arbitration through Online Dispute Resolution (ODR) portal SMARTODR. To know more about grievance redressal mechanism click here.

© 2024 Quantum Advisors India | Designed and developed by Solharbor