We examine a growing trend amongst corporations: a diminishing focus on Environmental, Social, and Governance (ESG) initiatives. A recent survey of c-suite executives reveals that short-term mindsets, fears of greenwashing, and internal structure deficiencies are hampering sustainable progress. We explore the phenomenon of "EHG" (Eyewash, Hogwash, and Greenwash), its correlation with company size, and specific instances within India's sustainability landscape.

Environmental, Social and Governance (ESG) efforts have slipped down corporate priority lists, according to a new global survey of c-suite executives that found that short-term mindsets, fears of greenwashing and a lack of internal structure are all hindering progress on the sustainability front.

Just a decade ago, ‘sustainability’ was a topic managed not by sustainability departments (which hardly existed back then), but by corporate communications teams. In fact, it didn’t have anything to do with business operations or company strategy. Back then, sustainability referred to corporate social responsibility aka its social licence to operate rather than to strategic decisions or actions, and, more often than not, was manifested as a mere advert on top of an annual report. Today, it’s a lot more!

As regulators and stakeholder’s move up the ESG curve, the world of sustainable investing is evolving for better. While businesses today strive to embody values such as sustainability, environmental consciousness, and social responsibility, there exists a lingering fear of greenwashing and the potential traps it presents. In a previous article, we explored the concept of "EHG" or "Eyewash, Hogwash, and Greenwash," shedding light on strategies to overcome the pitfalls of superficial sustainability claims. However, most corporations seem to have realized that they cannot remain deaf to the rising clamour for substantiating their sustainability claims and have started providing tangible evidence of the steps taken and the relevant outcomes instead of conjuring green images.

With companies stretched for resources or due to their myopic focus on short term profitability, they are seeking newer ways of “EHG” as they seek to capture investor, consumer and regulator compliances on sustainability. Companies are coming up with nuanced and innovative ways on EHG and our research suggests that its rampant in large companies in hard to abate sectors, emerging economies, mid and small enterprises and importantly companies with shady governance.

Its highly likely that EHG will reduce, maybe not in the near future, but over time. There is going to be a time when, as transparent and traceable data is taken more seriously, more EHG allegations will emerge, and more companies may be implicated. But this is a symptom of greenwashing being tackled.

The relationship between company size and greenwashing is increasingly evident. From governments with significant resources to renowned brands, there is a strong desire to capitalize on the sustainability trend sparked by the pandemic. These entities are willing to invest substantial sums of money to create an illusion of net-zero emissions, plastic neutrality, and diversity inclusivity rather than making meaningful changes.

An interesting tactic employed in greenwashing involves substituting plastic with another material, like aluminium, and marketing it as a greener, more environmentally friendly, socially responsible, and convenient alternative. However, this is merely a deceptive manoeuvre. It conveniently overlooks the fact that this seemingly superior alternative performs poorly in terms of carbon emissions and its impact on biodiversity.

Interestingly, it wouldn't be surprising if someone were to publish a standardized guidebook on greenwashing even before standardized disclosure norms for environmental, social, and governance (ESG) practices are firmly established.

In the realm of sustainable investment opportunities in India, it is crucial for investors to acknowledge India's classification as a "High risk" country when it comes to environmental, social, and governance (ESG) factors. Nonetheless, Indian companies are progressively realizing the advantages of being recognized as environment friendly and sustainable. To align with ESG standards, these companies are implementing extensive restructuring of their manufacturing processes, closely scrutinizing waste management practices, and establishing dedicated teams to monitor not only their organization's carbon footprint but also that of their supply chains. Despite these genuine efforts and evident impact on businesses, there are many who resort to EHG practices as a way to look cleaner, greener and sustainable. Lets examine real world tricks employed to greenwash, eyewash and hogwash by corporates in India.

One of the chemical companies declarations regarding their ambient air quality concentration in their environment impact assessment report for the proposed expansion of their chemical’s unit in Solapur, Maharashtra, India is nothing short of hogwash. Despite their claims of complying with the National Ambient Air Quality Standards (NAAQS), the data available on the central pollution control's website tells a completely different story. The recorded PM10 data for a period of three months between October and December 2020 reveals not only a blatant misrepresentation of data by the company but also a clear violation of India's NAAQS.

The PM10 levels reported by the Company exceed the prescribed standards, exposing the local community to health risks. PM10 particles, being tiny enough to act like a gas, can deeply penetrate the lungs and cause a range of adverse health effects, including respiratory issues, heart problems, and even premature death in individuals with pre-existing conditions. Such disregard for accurate reporting and compliance with air quality standards is both concerning and unacceptable.

Quantum research utilizes data from pollution control boards, air quality measurements, and various environmental data sources to diligently verify the environmental claims of companies. The research methodology places a strong emphasis on identifying and circumventing the pitfalls of greenwashing, ensuring its thorough detection and prevention.

Amid a flourishing market rally and soaring valuations of start-ups, a tech company recently made its debut on the Indian stock exchanges. This listing provided an opportunity for some of its private equity owners to exit their positions. One of these investors, who still holds a 15.18% stake in the company, appointed a Partner from their Statutory Audit firm as a nominee director on the start-up's board. This appointment took place on March 30, 2015, and the nominee director assumed the role of a non-executive director.

The nominee director served on the board for approximately seven years, playing a strategic role in the company's growth. However, just before the listing on February 26, 2022, they chose to step down from the board. Interestingly, shortly after their resignation, on March 1, 2022, the director was reappointed as an independent director. Currently, they hold the position of Chairman of the board and are also a member of the Audit Committee.

From a legal perspective, the company has fulfilled all the regulatory requirements. However, there are concerns regarding the true independence of the board. Ideally, an independent director should have no prior connections to the board or the largest shareholder of the company. This situation raises questions about adherence to good corporate governance standards and suggests a potential disregard for true independence.

One of the largest cement companies in India and the third largest globally (excluding China) has established a grinding facility with a capacity of 3 MTPA, situated on a 90-acre plot in Athgarh, Cuttack (Odisha). Despite being near environmentally sensitive forest areas, the company obtained environmental clearance.

This company claims to prioritize environmental sustainability and compliance with regulations, but their actions raise concerns about greenwashing. Activities within the eco-sensitive zone of the adjacent wildlife sanctuary require permission from the National Board for Wildlife (NBWL), making the process more complex. Regulations dictate that manufacturing plants should be at least 8 kilometres away from environmentally sensitive areas. However, in their environmental impact assessment report, the company conveniently adjusted the distance to the Kapilas Wildlife Sanctuary to 8 kilometres to obtain clearance, even though satellite images clearly show that the actual distance to the forest is only 3.82 kilometres.

This deliberate misrepresentation of the proximity to the sanctuary demonstrates a lack of genuine commitment to environmental protection. The land granted to the company includes a diverse range of medicinal plants, which are crucial for the local ecosystem. The cement plant's presence threatens the delicate balance of the pastureland, which serves as a natural corridor for elephant communication between the Sankhapoi Reserve Forest and Subasi Reserve Forest.

The local community is already grappling with a severe water crisis during the summer months, and the introduction of the cement plant is expected to exacerbate this situation. The company's failure to address or mitigate these concerns shows a disregard for the well-being of the local population and the environmental impact of their operations.

This cement company is creating an illusion of environmental responsibility while disregarding the genuine concerns of local communities and the preservation of the delicate ecosystem. It is essential for stakeholders and regulators to be aware of such instances of greenwashing to ensure that companies genuinely uphold sustainable practices rather than merely engaging in superficial gestures for public relations.

Quantum's research surpasses the superficial approach of merely checking off boxes, delving instead into a comprehensive assessment of the company's promises and obligations through active on ground research and active engagement. This engagement spans across the company itself, including all stakeholders, NGOs, various channels, the supply chain, and local entities associated with the company's operations. By adopting this thorough approach, Quantum effectively sidesteps the pitfalls of greenwashing, ensuring that any potential risks to the company's reputation are identified and addressed proactively.

In the realm of ESG credentials, there exists a notable reliance on self-disclosure and self-certification. This practice opens the door for organizations to potentially make exaggerated claims, aiming to position themselves favourably. It's important to note that this phenomenon extends beyond companies alone, encompassing investment managers and sustainable indices as well. Investment managers can attain impressive certifications as responsible managers through self-certification, without the need for independent verification of their claims. Likewise, sustainable stock market indices can gain recognition without fully embodying their intended purpose. While they might possess some level of sustainability, their composition is primarily driven by market capitalization rather than their sustainability credentials. Consequently, a company that lags in ESG performance could receive a higher weighting in the index purely due to its large size, whereas a superior ESG company might receive a smaller portion of investments. This implies that your financial support may end up favouring a weaker ESG company over a stronger one.

The presence of 26 cement grade limestone mines in Balodabazar-Bhatapara, Chhattisgarh poses a significant threat to the local fauna and ecosystem. Chhattisgarh is known to be home to 45 endangered species, many of which are endemic to the state and have medicinal value. Unfortunately, these mining activities result in the loss of valuable flora, disrupting the delicate balance of the local ecosystem.

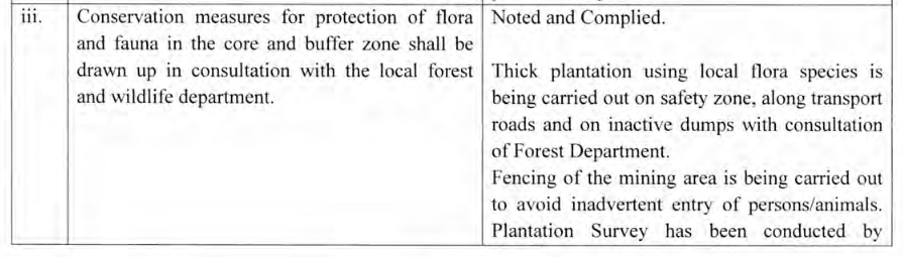

Exhibit: Company disclosure

Of concern is the tendency of mining industries to overlook or conceal evidence of endangered fauna during initial land acquisition studies. This deliberate omission distorts the true environmental impact and undermines efforts to protect and conserve endangered species. It also hampers our understanding of the ecological consequences of mining and cement plant activities. The loss of natural vegetation and the concealment of data regarding endangered fauna represent a significant setback in our mission to preserve biodiversity and sustain the fragile ecosystems that support life.

Preserving and safeguarding our natural heritage is a shared responsibility, and by actively combating these eye washing practices, we can secure a sustainable future for both endangered species and the local communities that depend on the integrity of the region's ecology.

In today's world, capitalism has taken on a highly competitive nature. Businesses are capitalizing on the emotional vulnerability of consumers and investors by purposefully manipulating information to maintain imbalances and distortions. Their objective is to exploit the growing importance placed on environmental consciousness. Unfortunately, this deceptive strategy is especially prevalent in industries that lack genuine sustainability practices, thus undermining the efforts of businesses that truly operate sustainably.

"Greenwashing" is an issue that revolves around ethics and corporate social responsibility. It raises concerns when companies claim to be environmentally friendly but potentially fail to meet their commitments. This is where "Corporate Governance" comes in. Corporate Governance involves assessing the credibility of a company's board and management, as well as analysing their decision-making process. The impact of these decisions on various stakeholders provides evidence of the company's principles and values.

At Quantum, we have been using our proprietary integrity screen since 1996 to identify instances of poor corporate governance in India. Within our ESG (Environmental, Social, and Governance) framework, governance plays a central role in our analysis. We strongly believe that deficiencies in corporate governance often align with underperformance in social and environmental aspects, making it an effective indicator of broader issues.

Quantum firmly believes in taking a meticulous approach when evaluating ESG (Environmental, Social, and Governance) credentials. Instead of solely relying on self-disclosures, we conduct a comparative analysis of a company's data across different parameters and compare it to datasets encompassing all companies within the sector. This enables us to uncover potential areas that require further investigation. We also understand the importance of gathering information from unconventional sources, including NGOs, local communities, and regulatory boards.

Our approach involves engaging with sustainability officers and key management personnel to gain valuable insights into a company's ESG strategy and address any inquiries we may have. We recognize that some companies may present a facade of sustainability without providing substantiated information. To ensure a thorough assessment, we go beyond surface-level evaluations by conducting on-site visits to plants, including those within the supply chain, to obtain first-hand verification of their purported actions.

Furthermore, we believe in conducting a comprehensive 360-degree check by actively interacting with various stakeholders such as dealers, vendors, employees, customers, and regulators. This holistic approach allows us to identify any exaggerated or unsupported claims made by the company, ensuring a thorough evaluation of its ESG practices.

It would be much simpler to differentiate between green washers and genuinely sustainable entities if investors and the public had a standardized approach and access to a robust set of data for comparison. Existing private ratings systems can be unreliable, and corporate reporting is often inconsistent and difficult to compare. Until better regulations are implemented to enhance transparency and standardize disclosures, as well as ensure the quality of ESG (environmental, social, and governance) actions, investors should be aware that what they are told may not always align with reality. Sometimes, ESG can be more like EHG, with misleading information being presented.

Fortunately, policymakers and regulators worldwide are taking strong measures to protect customers and prioritize stakeholders' interests. As a stakeholder, it is important to stay informed about emerging trends in greenwashing and educate oneself to avoid being deceived by misleading practices. This proactive approach will help ensure that individuals make well-informed decisions and avoid being swayed by false representations.

Explore how our two main strategies – Predictable India Equity and India Integrity Equity - with demonstrated success of our tried and tested research and investment processes can ensure your India equity allocation will have higher predictable outcomes and no surprises.

20+ years of India Long-only, Liquid, High-Governance, Margin of safety = Predictability

Integrity screen since 1996, strategy Track record since 2000.

Liquid, proprietary Integrity Scores, Financial Soundness

Integrity Screen since 1996, enhanced criterion since 2015, strategy Track Record since 2019; strategy AuM: $9.7 mn Mandate Capacity: $5 billion

CIN: U65990MH1990PTC055279

SEBI PMS Reg. No.: INP000000187

1st Floor, Apeejay House,

3 Dinshaw Vachha Road, Backbay Reclamation,

Churchgate, Mumbai 400020, India

Tel: +91-22-6144 7900 / 22830322

Fax : 91-22-2285 4318

Email: info@QASL.com

In case of any grievance/complaint, you may contact Mr. Piyush Thakkar, Chief Executive Officer at Complaint@qasl.com. Investor can initiate dispute resolution by harnessing online conciliation and/or online arbitration through Online Dispute Resolution (ODR) portal SMARTODR. To know more about grievance redressal mechanism click here.

© 2024 Quantum Advisors India | Designed and developed by Solharbor